The Yen Carry Trade: A Tale of Global Finance

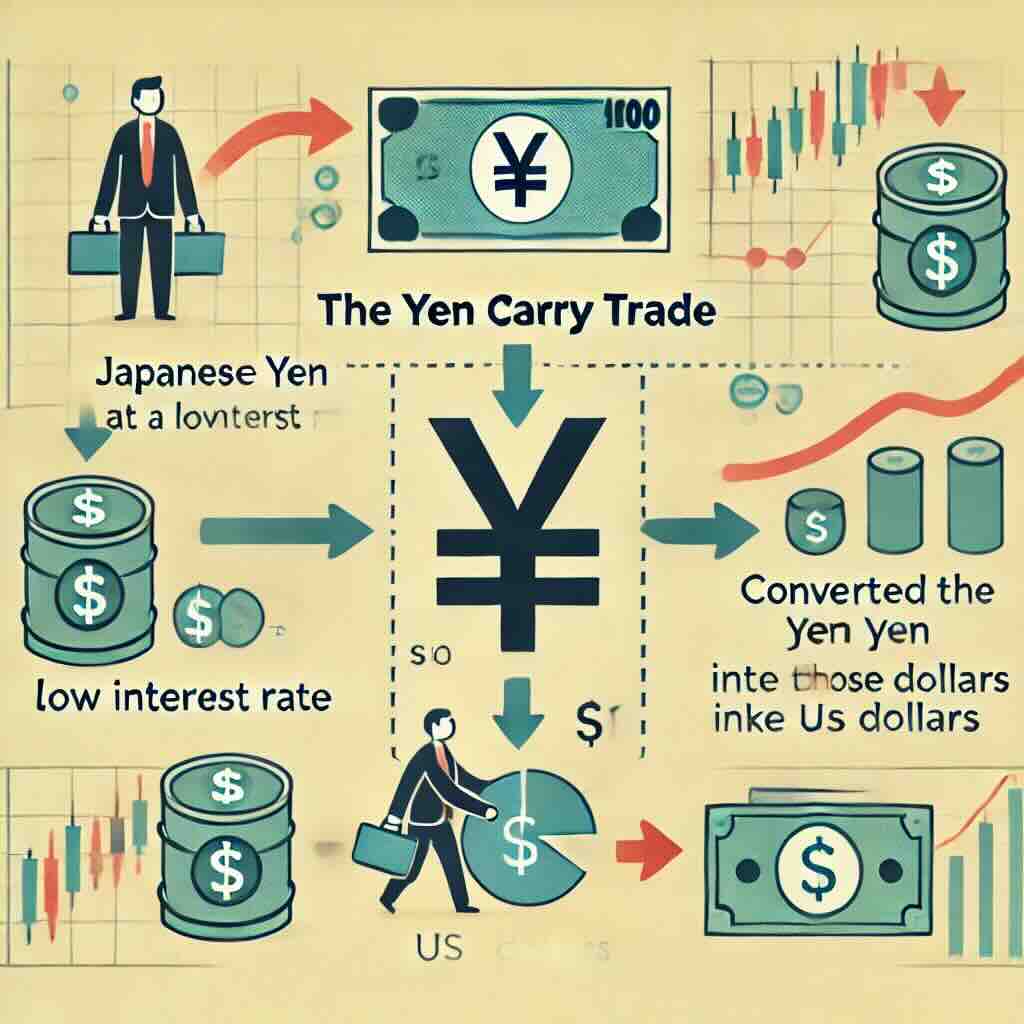

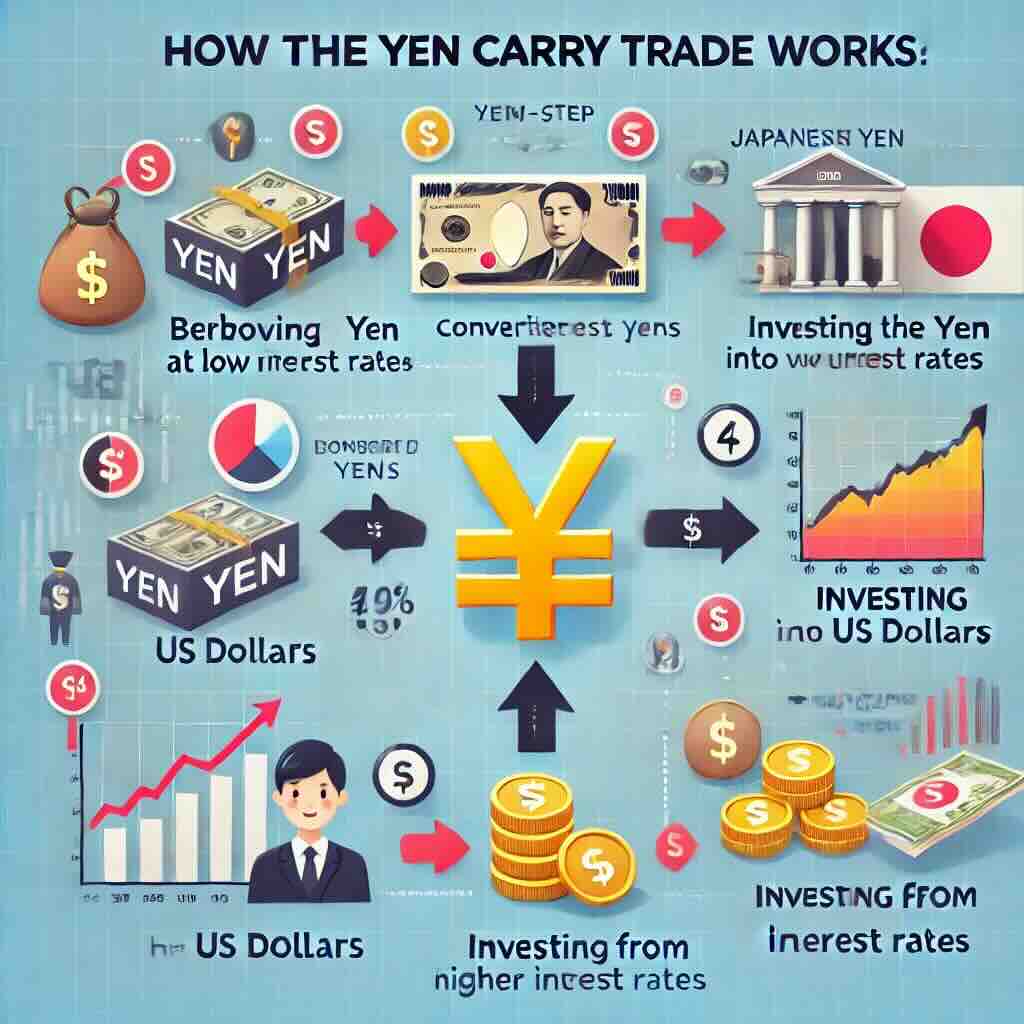

Understand the Yen Carry Trade: borrow Japanese Yen at low interest rates, convert to higher-yielding currencies, invest, and profit from the rate difference.

Imagine this: You are relaxing at your kitchen table in Tokyo as you drink green tea when suddenly a train of thought hits you. What if you could capitalize on Japan's original low-interest rates that are said to be the end of their economic woes? This is the world of the Yen Carry Trade, a finance strategy that has gripped the minds of investors globally.

The Birth of Mrs. Watanabe

It all began in the late 1980s. Japan's economy was super expansive which is why its bubble was at its highest, although, at the same time, due to it falling, the interest rates were universely set to rock bottom. Meet Mrs. Watanabe - No, not a single human being, but a nickname for Japan's housewife army investors. These sharp women have seen a possibility where the others have seen the stagnation.

"Why should we keep our yen lying around while there are plenty of things to be done with it?" they wondered. "Let's make it productive!"

The Yen Carry Trade: How does it work?

- Borrowing in Yen: At low interest rates available in Japanese Yen, the investor would borrow.

- Higher-yielding currency conversion: The borrowed yen is now converted into a higher interest rate currency like the US Dollar, Australian Dollar, or any other emerging market currency.

- Higher-Yielding Assets Investment: Such funds are invested in higher-yielding assets, like foreign bonds, stocks, or other financial instruments.

- Interest Rate Differential Profit: The difference between the low-interest rate paid on the borrowed yen and the higher returns earned on the investments.

Example of a Yen Carry Trade

An investor can borrow JPY at 0.1%, exchange it to USD, and invest in a US Treasury bond yield offering 2%. Assuming constant currency rates, the investor gains the difference of 1.9%.

A Global Financial Rollercoaster

The Yen Carry Trade, a force not confined to Japan, has the potential to significantly impact the global market. When fully utilized, it channels capital into purchasing assets worldwide, creating financial market imbalances. However, the reversal of this capital flow can lead to severe consequences, underscoring the importance of understanding its risks.

Think of this as a large game of Jenga with money. Each move builds the tower higher and more impressive, but one wrong move could cause everything to come crashing down.

The Risks: Walking a Tightrope

Certainly, not all would be just great and smooth. The Yen Carry Trade is like the dangerous performance of the rope dancer with the added difficulty of handling fire torches. A nice little gain can be turned into a loss by the currency distortions in a blink of an eye. Moreover, there are also the fluctuations in interest rates which usually change without any prior notification.

While the Yen Carry Trade can prove to be very profitable, there are certain considerable risks involved.

- Currency Risk: This is related to the devaluation of different profits due to changes in exchange rates. For instance, if the yen were to rise against the denomination of investment, then that could cause losses when converting it back to yen.

- Interest Rate Changes: Such sudden changes to interest rates by the BOJ or central banks of the invested currencies can ding returns.

- Market Volatility: Economic instability or geopolitical events can drive market conditions to change very fast. This would then affect currency values and asset prices alike.

Impact on the Financial Market

The Yen carry trade can have a big impact on global financial markets:

- Higher Liquidity: Money inflows into higher-yielding markets can raise liquidity and, hence, increase the prices of assets.

- Currency Valuation: Carry trade on huge scales tends to move the currency exchange rates in favor of appreciation of the target currencies and depreciation of the yen.

- Market Corrections: Whenever traders square off their positions, there can be a steep correction not only in currency markets but also in the assets market.

The Future: A New Chapter?

Recent Developments and Current Scenario - Interest rates in Japan have been near zero in recent years, encouraging ongoing borrowing of yen for investing in other countries. That's changing. The Bank of Japan recently raised its key interest rate a bit, and the yen also gained ground against the dollar. That erodes the profitability of the yen carry trade, creating the potential sell-offs across global stock markets as investors unwind their positions.

Currently, change is seen to be the order of the day in Tokyo because of the fact that the Bank of Japan suggested the possibility of setting higher interest rates while the yen seems to be getting stronger each day. Is this the end of the Yen Carry Trade as we know it?

Time alone will tell this. Nevertheless, one fact remains consistent-the narrative of the translate being life-support of the trade will not let us down. It not only depicts a man's ability but also serves as a warning about the endlessness of the international markets, which cunningly look different when they are in disguise.

Conclusion

The yen carry trade remains very attractive to many investors, who borrow at low Japanese interest rates to find better returns elsewhere. It is an extremely risky trade that exposes the investor to large currency and market fluctuations. For that reason, understanding the mechanics of this type of transaction and the risks associated with its execution becomes important to any investor who would want to include it in his investment portfolio.

The foreign exchange markets will give investors a better opportunity to understand the intricacies of the Yen Carry Trade, which will largely influence their potential for navigating the opportunities and challenges presented by global financial markets.

So the next time you are enlightened about the Yen Carry Trade, beware. It is not only about the digits on the screen. It's a story of those who take risks and those who seek chances, of global motion from local spot, and of the combined human quest for the best usage of money.

There's a chance that you might get inspired and follow your heart just like Mrs. Watanabe and set off on this adventure.