Leveraging Order Flow for an Edge in ES, NQ, and RTY Futures Trading

Leveraging order flow in ES, NQ, and RTY futures trading provides traders with real-time insights to make informed decisions and boost success.

The ES (E-mini S&P 500), NQ (E-mini Nasdaq 100), and RTY (E-mini Russell 2000) markets are three markets in which traders can uniquely benefit when considering capitalizing on market moves within different segments of the stock market. These indices offer large-cap U.S. stock in the case of the ES, tech-heavy stocks in the case of the NQ, and small-cap companies in the case of the RTY. For this being such a competitive and fast-moving marketplace, many traders now turn to order flow analysis for that competitive advantage.

Order Flow focuses on real-time data and immediate market sentiment, suitable for short-term trading strategies. Market Profile offers a structured view of market behavior over time, helping traders identify longer-term trends and key price levels. We will discuss Market Profile in another article.

Understanding Order Flow

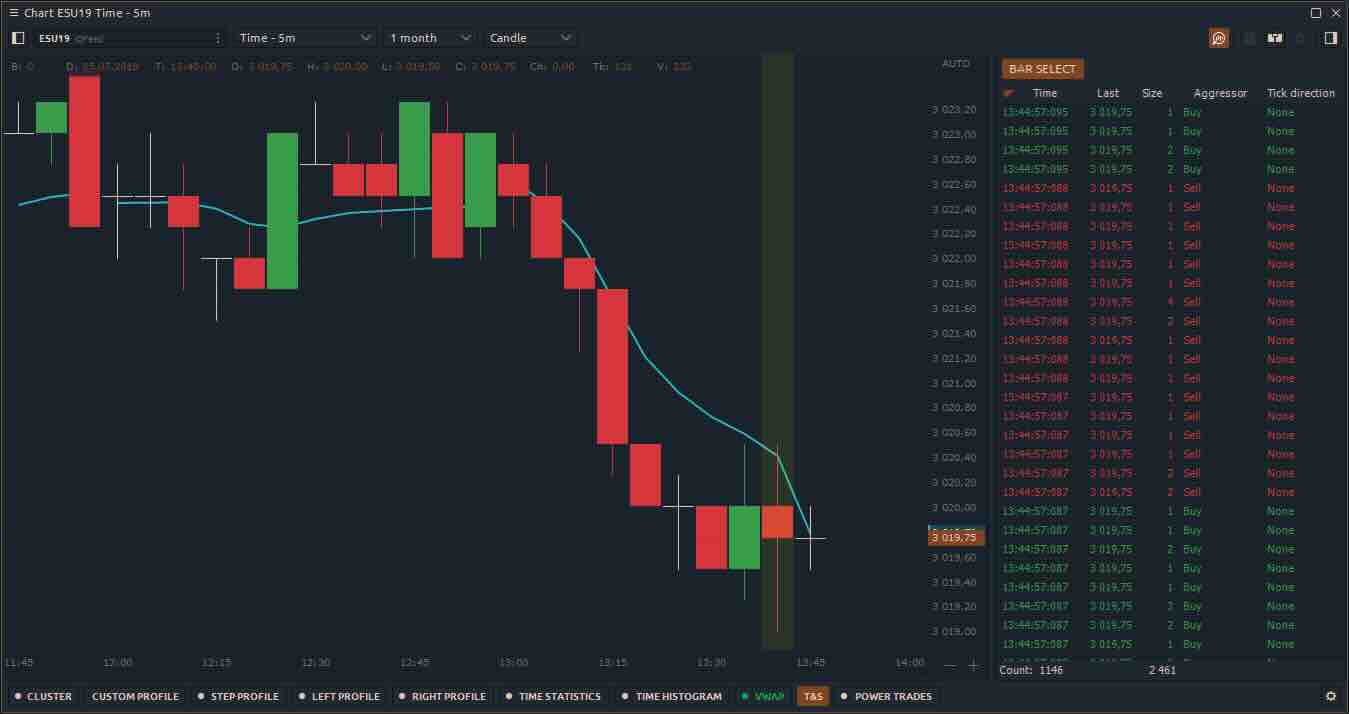

The order flow is the real-time track of market orders: the buy and sell orders made by traders, their size, and how they are matched in the market. Looking at the order flow can teach one a lot about the supply and demand dynamics that work in the marketplace. It may give one an important edge when predicting short-term price moves.

Order flow is the detailed record of transactions in a financial market, particularly about buying and selling orders that market participants place. It indicates real-time insight into the dynamics between supply and demand: how many buy or sell orders are on the table for which price and in what quantity?

Key Components of Order Flow

- Market Orders: These refer to orders that are executed at the prevailing price in the market. The existence of such orders points towards current buying or selling pressure in the market.

- Limit Orders: These are buy or sell orders at a specific price or better for a security. They will be sitting in the order book until the market reaches their stipulated price. Analysis of the accumulation of limit orders can give one insight into potential support and resistance levels.

- Order Book: A list of all existing buying and selling limit orders on the market at different price levels. It reveals the depth of the market and at which level considerable buying or selling interest is located.

- Trade Executions: This refers to the actual transactions that occur when buy and sell orders are matched. Analysis of the volume of these executions helps traders understand where the market is likely to move.

- Bid-Ask Spread: The difference between the highest price a buyer is ready to bid and the lowest price a seller is ready to ask for. The size of this spread can provide clues about market liquidity and volatility.

How Traders Use Order Flow

Identifying Market Trends: By studying the flow of orders, a trader can determine whether there is prevailing buying or selling pressure that could be the cause of a trend.

- Spotting Reversals: In case, after observing selling pressure for some time, an increase in buy order flow shows up—it can indicate a high probability reversal in market direction.

- Determining Support and Resistance Levels: Large order clusters at a certain price level may act to support (buying interest) or resist (selling interest) certain prices, allowing traders to pin down their entry and exit.

- Improving Trade Execution: An understanding of where large orders are likely to be placed can benefit a trader in streamlining the timing and price of a trade, thus reducing slippage and hence enhancing overall trading efficiency.

In other words, order flow is a real-time tool showing visibility into current supply and demand in the market, giving one an edge in taking educated decisions on trading. Traders could thus understand market behavior, anticipate price movements, and improve trading strategies through monitoring and analyzing order flow.

Why Order Flow is so Important in Futures Trading

-

Market Sentiment: Order flow reveals to traders the perception the market holds at any point in time. Traders can easily judge, based on the volume and direction of trades, whether buyers or sellers control the marketplace and, therefore, make very wise decisions about when to enter, exit, or hold onto positions.

-

Identifying Key Levels: Order flow will reveal key prices where significant buying or selling is taking place. These are the locations where often either support and resistance resides, which gives us vital information for setting entry and exit points.

-

Spot Reversals: Order flow can show a trader potential market reversals. For instance, if a market has a strong selling trend, but the order flow begins to increase concerning buy orders, it may indicate that the selling pressure is diminished and the market could be in for a reversal.

-

Timing of Execution: Understanding order flow helps traders further their execution timing. This can help to avoid slippage and aid in getting better fills, hence increasing overall trading efficiency.

-

Noise Filtering: Futures markets are very noisy, and price swings can really shake out traders whose only emphasis is on technicals. The order flow enables a trader to filter some of this noise by focusing on real market transactions and therefore gives a clearer picture of what the true market action entails.

Applying Order Flow in ES, NQ, and RTY

In ES, NQ, and RTY futures, the order flow can be of special significance, considering the markets are liquid and volatile. Traders can use order flow tools such as depth of market (DOM) display, footprint charts, and volume profile analysis to watch and interpret the flow of orders in real time.

-

ES Futures: Having such a huge volume and tight spreads makes ES very popular among futures traders. Order flow can help to identify large institutional orders which may point towards large market moves.

-

NQ Futures: NQ, with its tech-heavy focus, can become a tad more volatile, especially around tech earnings seasons or major economic reports; flow can give the trader a bit of a heads-up on sudden spikes or drops.

-

RTY Futures: Being a small-cap index, RTY can have influences due to macroeconomic factors. The order flow analysis could help traders in identifying early indications of change in the investor sentiment towards small-cap stocks.

Conclusion

Order flow analysis is a strong feature to provide futures traders with a big edge in the ES, NQ, and RTY markets. This is because order flow helps traders garner real-time insights on market activity so that better decisions can be made that further develop their trading strategies, leading to more satisfactory trading performance. In highly liquid markets such as ES or the more volatile NQ and RTY, mastering order flow can be the key to consistent success in futures trading.