Jerome Powell - The Federal Reserve's Strategic Response to Economic Developments

Jerome Powell outlines the Fed's balanced approach to maintaining economic stability by managing inflation and employment through adaptive monetary policy.

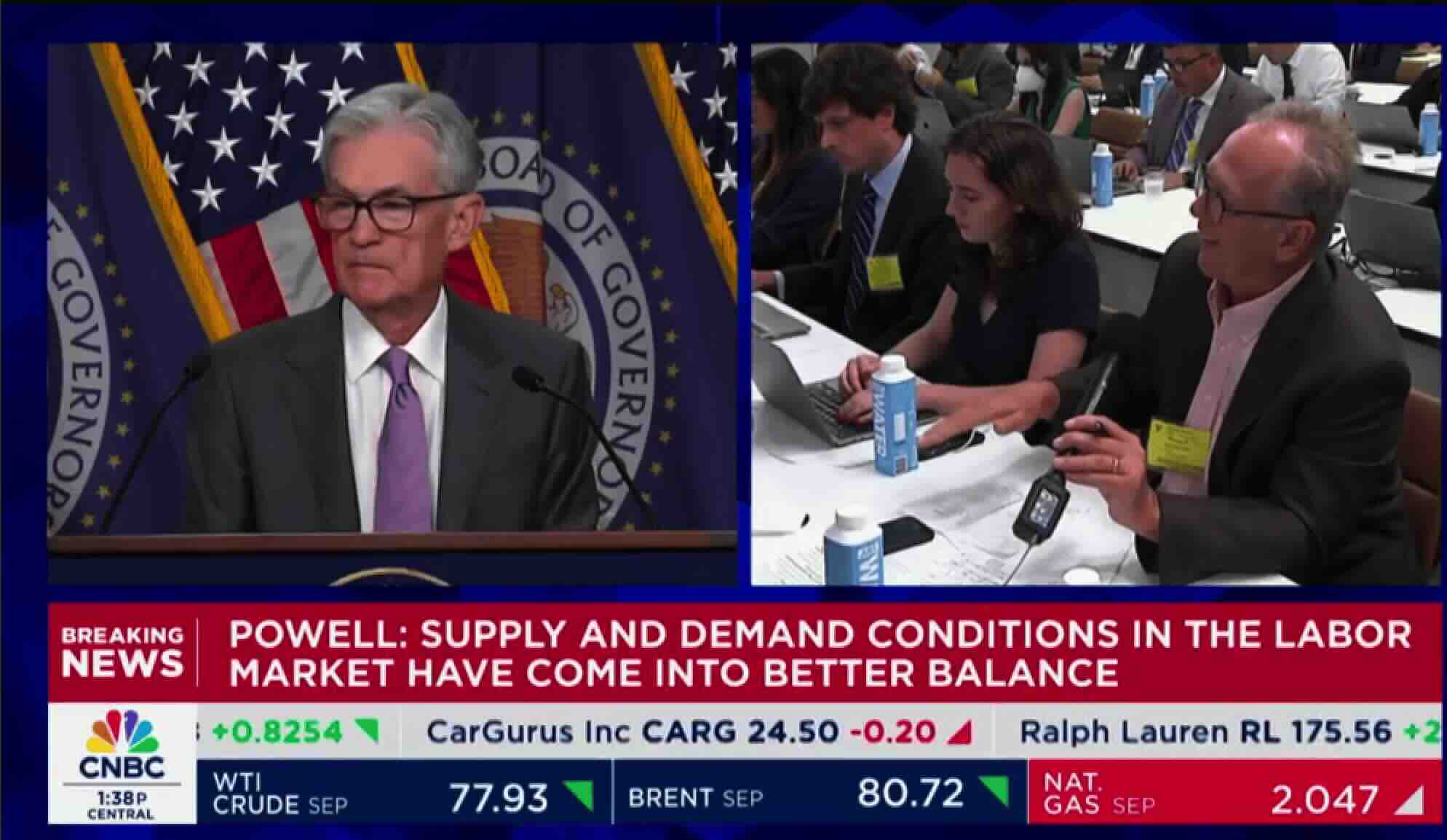

Today, July 31st 2024, Federal Reserve Chair Jerome Powell outlined the current stance of monetary policy in the United States, and to do so, he put a spotlight on contemporary economic developments and the Fed's approach toward managing inflation and employment. His remarks consist of an explanation regarding the outlook of the economy and strategic decisions taken by the FOMC in order to sail through the challenges of inflation and employment.

Economic Developments and Recent Trends

Powell opened by pointing out that recent indicators suggest continued solid expansion in economic activity. GDP growth moderated to 2.1% in the first half of the year, compared with 3.1% in the previous year. Private domestic final purchases, or PDFP—a measure that excludes inventory investment, government spending, and net exports—rose at a 2.6% pace during the same period. This measure has often been accoladed as a clear signal of underlying demand within the economy.

Consumer spending has slowed from last year's robust pace but remains solid. Equipment and intangible investment has picked up, showing recovery from its anemic pace last year. Housing investment stalled in the second quarter after a strong rise in the first; improving supply conditions bolster resilient demand.

Labor Market Dynamics The labor market has indicated a better supply-demand balance. Building in the March jobs figure, the average payroll job gains were 177,000 per month for this quarter, a solid pace but lower than the one realized in the first quarter. Meanwhile, the unemployment rate edged up to 4.1 percent, but below is still considered low.

The labour supply has picked up—partly due to higher participation rates among 25–54-year-olds, but also a reflection of the strong pace of immigration.

Nominal wage growth has retarded a bit over the past year. The gap between jobs and workers has also grown more modestly of late. Taken together, labor market conditions are about the same as they were on the eve of the pandemic, very strong but not red-hot.

Inflation and Monetary Policy

Inflation has fallen considerably during the past two years, but it is still above the longer-run goal of 2%. Overall Personal Consumption Expenditures, or PCE, prices moved up 2.5% during the 12 months ending in June; core PCE prices that strip out food and energy, goods prone to big changes, climbed 2.6%. Long-run inflation expectations have stayed very well anchored, as reflected in surveys of households, businesses, forecasters and in measures drawn from financial markets.

The FOMC voted to keep the target range for the federal funds rate within the area of 5.25% to 5.5%, balancing dual mandates that address maximum employment and stable prices. Powell hit home the view of the Committee, which is aware that high inflation has been causing suffering, particularly in families who can least afford to pay more for food, shelter, and transportation.

Future Outlook and Adjustments in Policy

He also reiterated, as he had earlier in the speech, that FOMC monetary policy actions are data-driven and will be adjusted appropriately to achieve their goals. He cautioned that it would be unwise to cut back on policy restraint prematurely or excessively, thus risking reversal of a lot of the progress achieved on inflation. Meanwhile, cutting back policy restraint too late or too little could unduly weaken economic activity and employment. The Committee is very prepared to respond if the labor market were to weaken unwelcome or inflation were suddenly to heighten from expectations. They stand ready to watch incoming data and the developing outlook—is an important part of the careful approach for making informed decisions that will help best foster their maximum employment and price stability goals.

Conclusion

Jerome Powell's speech reaffirmed the Federal Reserve's commitment to cleverly maneuvering through treacherous economic landscapes using a balanced monetary policy approach. The Fed will do so by reaching for an appropriate restrictive policy stance geared toward aligning demand with supply and, hence, easing off the upward pressure on inflation. That is what the Fed views should secure sustainable economic growth that delivers maximum employment and price stability.

Fed policies will adapt to the changing economy while remaining focused on serving the American people and the broader economy overall. The Federal Reserve acts vigilantly and adaptively to constitute the mainstay of stability in these unpredictable times, with their recommended measured response to dual challenges: inflation and employment.

Key Takeaways from Jerome Powell's Address

Monetary Policy Stance

The Federal Reserve has kept the respective monetary policy quite restrictive to make demand equal to the available supply and to reduce inflationary pressures.

Economic Activity

Recent indicators point to solid economic activity, with GDP growth moderating to 2.1 percent in the first half of the year.

Final private domestic purchases increased by 2.6%, pointing to the underlying strong demand.

Consumer Spending and Investment

Consumer spending has slowed, though it remains solidly underpinned.

Equipment investment or spending for intangibles has risen from last year's low level.

Housing investment stalled in Q2, following an optimistic Q1, based on the improving supply conditions.

Labor Market Conditions

The average job gain in the second quarter was 177,000 a month. The jobless rate is now 4.1%.

Key drivers include a higher participation rate in the labor force by persons aged 25-54 and strong immigration.

Nominal wage growth has both declined, and the gap between jobs and workers has narrowed.

Inflation Trends

Inflation, although still above the 2 percent objective, was slightly more subdued; total PCE prices rose 2.5 percent, while core PCE prices picked up 2.6 percent.

The formation of long-term inflationary expectations is well anchored.

Policy Decisions

The Federal Reserve voted to keep the federal funds rate within a range of 5.25% to 5.5% and to continue reducing its security holdings.

The future rate adjustments will likely be data-driven in respect of activity and the trends between economic activities and inflation.

Commitment to Goals

The Fed still says it is committed to getting inflation back down to 2%, while maintaining maximum employment.

The Fed's actions are aimed at ensuring price stability and supporting economic growth.

Forward Guidance

The Fed will adjust monetary policy as needed to respond to economic changes, with a focus on not reducing policy restraint prematurely or excessively. Ready to respond in case of constituted unforeseen changes within the labor market or inflationary rates.

Public Mission

Emphasize how communities, families, and businesses across the country were affected by Fed actions. An economic long-term stabilitycommitment for the benefit of all Americans.